straight life policy term

Straight life insurance is more commonly known. Straight Life Policy an ordinary life policy or whole life policy.

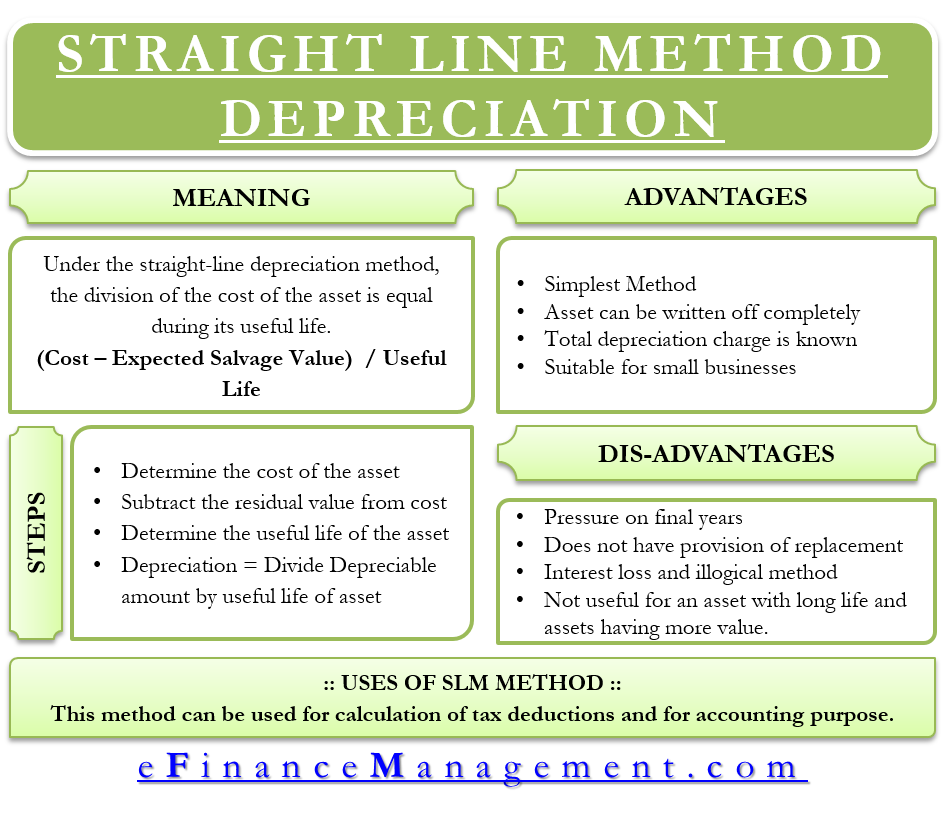

Straight Line Depreciation Efinancemanagement

Once you pass the death.

/stacks-of-coins--a-compass-and-documents-signaling-finances-184104157-eea22b5b70b744318f04c2b6f54a5ef4.jpg)

. Like other forms of whole life insurance the death benefit of a straight life policy is. The premiums in this type of life insurance coverage are stable meaning they. Straight life insurance is known as.

A straight life insurance policy offers coverage that lasts a lifetime with premiums that stay the same over the life of the policy. A straight life insurance is a type of policy that provides a lifetimes worth of coverage for you and your loved ones. Straight life insurance is more commonly known as whole life.

This type of policy can be used as an estate planning tool or to provide financial security. A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or. If you are looking for an insurance product that will provide some long-term planning a straight life policy is made to last a lifetime so it might be a policy to look into.

However ending the policy means you no. A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes. A straight life insurance policy offers coverage that lasts a lifetime with premiums that stay the same over the life of the policy.

Straight lifeA straight life insurance policy is a type of permanent insurance that provides a guaranteed death benefit and has fixed premiums. Straight life insurance is a type of whole life insurance. A straight life insurance policy provides coverage for a lifetime with constant premiums throughout the policys term.

A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or. A straight life policy which is sometimes referred to as a straight life annuity is a type of plan thats designed to provide a regular income to the annuitant as long as they live. This terminology denotes that premiums for the plan will be level meaning they will not increase or decrease.

What is Straight life. What is a straight life insurance policy. Straight life insurance has level premiums you pay until death or until the policy is considered paid in full.

An annuity or other insurance plan that provides the policyholder with monthly payments for the remainder of hisher life. A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or. Straight life insurance is a type of policy that pays out a benefit to the policyholder upon their death.

It is also known as whole life insurance. What is a Straight Life Policy. A whole life policy in which premiums are payable as long as the insured lives.

Straight refers to the premium structure of the whole life insurance policy. After death however the payments cease and the. A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or.

Joint And Survivor Annuity The Benefits And Disadvantages

/stacks-of-coins--a-compass-and-documents-signaling-finances-184104157-eea22b5b70b744318f04c2b6f54a5ef4.jpg)

Straight Life Annuity Definition

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

Whole Life Insurance Definition

How You Can Increase Your Insurance Sales With This 8 Tips Insurance Sales Life Insurance Sales Term Life Insurance Quotes

Life Insurance Over 70 How To Find The Right Coverage Life Insurance Quotes Term Life Insurance Quotes Term Life

Period Certain Annuity What It Is Benefits And Drawbacks

Annuity Payout Options Immediate Vs Deferred Annuities

Annuity Payout Options Immediate Vs Deferred Annuities

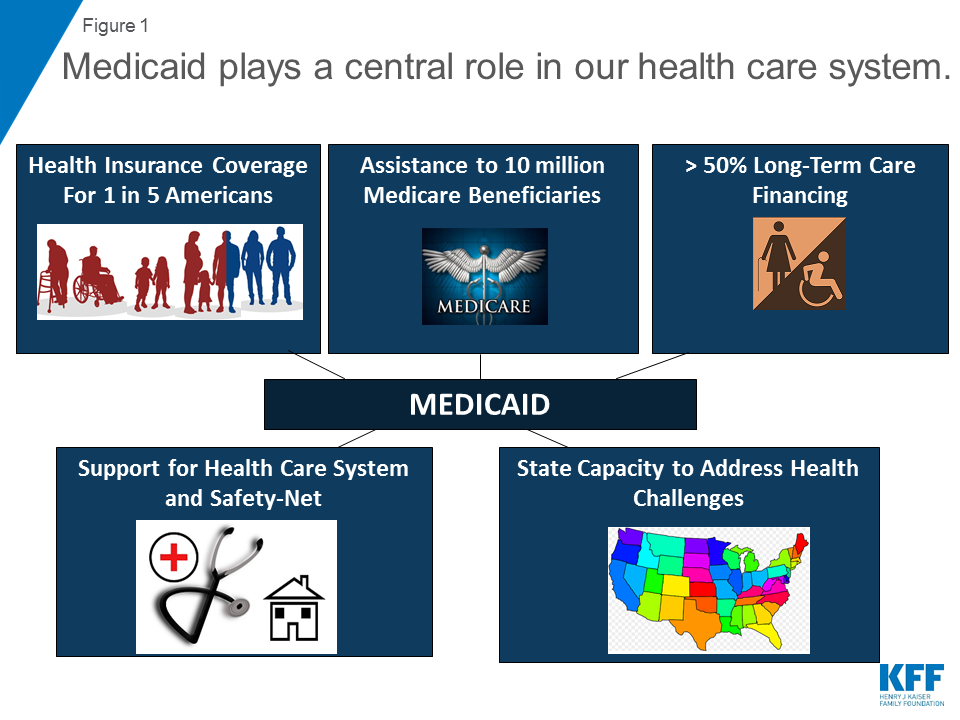

10 Things To Know About Medicaid Setting The Facts Straight Kff

Straight Life Annuity Definition

What Is Straight Life Insurance Valuepenguin

Lcx Life A Life Insurance Settlement Company Life Life Insurance Health Challenge

When Can You Cash Out An Annuity Getting Money From An Annuity

5 Reasons Why Buying Life Insurance In Your 30s Is A Good Idea Life Insurance Life Insurance Companies Insurance

The Cost Of Life Insurance Depends On Many Different Factors On A Person S Profile Because The Ins Life Insurance Facts Life Insurance Marketing Life Insurance

How Much Are Life Insurance Quotes Life Insurance Facts Life Insurance Quotes Whole Life Insurance

/GettyImages-184985261-257061c6b35546779a16b51ca1e9da8e.jpg)