kansas vehicle sales tax estimator

Kansas Vehicle Property Tax Check - Estimates Only. Title fee is 800 tag fees vary according to type of vehicle.

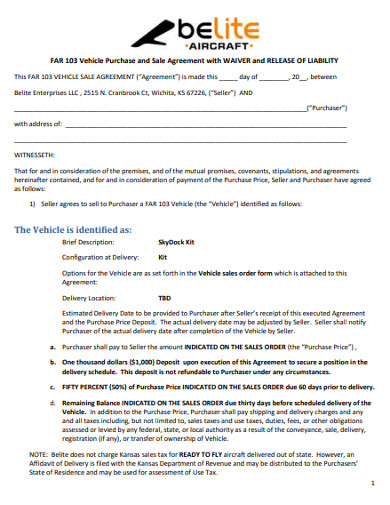

Vehicle Purchase Agreement 10 Examples Format Pdf Examples

137 average effective rate.

. The sales tax in Sedgwick County is 75 percent. Vehicle tax or sales tax is based on the vehicles net purchase price. Vehicle Tax Costs.

However rates can vary depending on the location where the vehicle is purchased in the state. Vehicle Property Tax Estimator Use this online tool from the Kansas Department of Revenue to help calculate the. Vehicle property tax is due annually.

Title and Tag Fee is 1050. Title fee is 800 tag fees vary according to type of vehicle. The treasurers also process vehicle titles and can register vehicles including personalized license plates.

Modernization Fee is 400. There is an extra local or county sales tax. If you are unsure.

Administrative Fee 275 Retail 75 for AZ Plan 100 XD Plan Sales Taxes and Finance Charges are additional to the. Search for Vehicles by VIN -Or- Make Model Year -Or- RV Empty Weight Year. The current statewide sales tax in Kansas is 65.

He earned his law degree in 1979 from the Washburn University School of Law and his Masters of Laws in Taxation degree from the. Use this online tool from the Kansas Department of Revenue to help calculate the amount of property tax you will owe on your vehicle. Title fee is 800 tag fees vary according to type of vehicle.

For your property tax amount use our Motor Vehicle Property Tax Estimator or call 316 660-9000. Buy a new Ford F-150 truck or schedule auto service at our KS. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Kansas local counties cities and special taxation districts.

Search for Vehicles by VIN -Or- Make Model Year -Or- RV Empty Weight Year. Burghart is a graduate of the University of Kansas. Vehicle Property Tax Estimator Sedgwick County Kansas.

Kansas Vehicle Property Tax Check - Estimates Only. The Tax Calculator should only be used to estimate an individuals tax liability. You will find the basic fees for estimating the cost to tag a newly purchased vehicle in the table below.

KS Motor Vehicle Property Tax and Fee Estimator Drivers License Tag Department Treasurer Pages Contact Info Phone. Use the Kansas Department of. Its fairly simple to calculate provided you know your regions sales tax.

Kansas 105 county treasurers handled vehicle registration tags and renewals. Kansas Department of Revenues Division of Vehicles launched KnowTo Drive Online a web-based version of its drivers testing exam powered by Intellectual Technology Inc. You will pay property tax when you initially register a vehicle and each year when you renew your vehicle registration.

Estimating the Cost to Tag a Newly Purchased Vehicle.

New And Used Ford Dealer Beloit Beloit Auto Truck Plaza

Calculate Auto Registration Fees And Property Taxes Geary County Ks

Used Cars For Sale In Lawrence Ks Cars Com

10 States With The Highest Sales Taxes Kiplinger

Calculate Auto Registration Fees And Property Taxes Geary County Ks

Motor Vehicle Division Unified Government Of Wyandotte County And Kansas City

Dmv Fees By State Usa Manual Car Registration Calculator

Motor Vehicle Lyon County Kansas

A Sales Tax Hike For Firefighters Is Likely To Be Decided By A Tiny Fraction Of Kansas City Voters Kcur 89 3 Npr In Kansas City

Tax Calculator Chanute Ks Official Website

Used Cars For Sale In Kansas City Mo Cars Com

Car Tax By State Usa Manual Car Sales Tax Calculator

Missouri Vehicle Registration Of New Used Vehicles Faq

Kansas Sales Tax Calculator And Local Rates 2021 Wise

Missouri Car Sales Tax Calculator

Kansas Department Of Revenue Division Of Vehicles Vehicle Tags Titles And Registration

Motor Vehicle Division Unified Government Of Wyandotte County And Kansas City