salt tax cap news

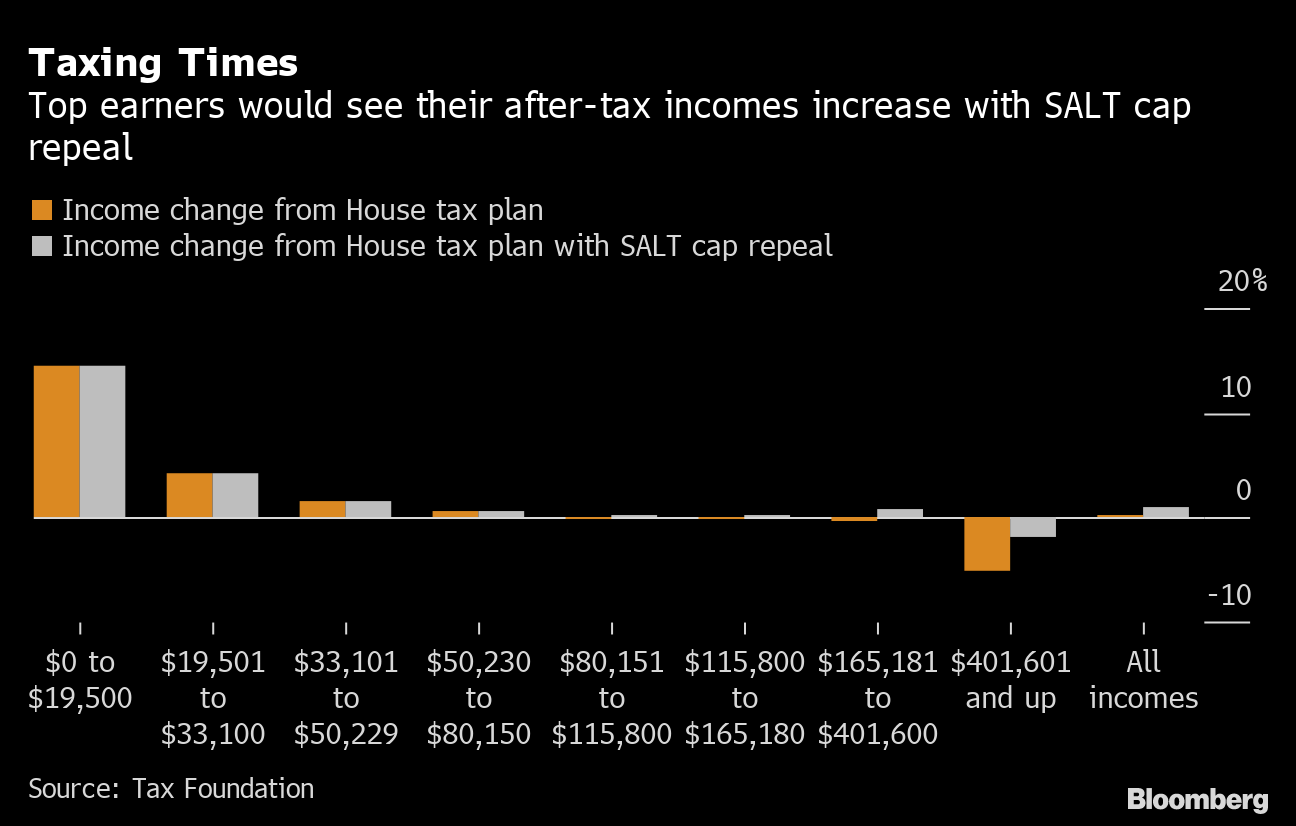

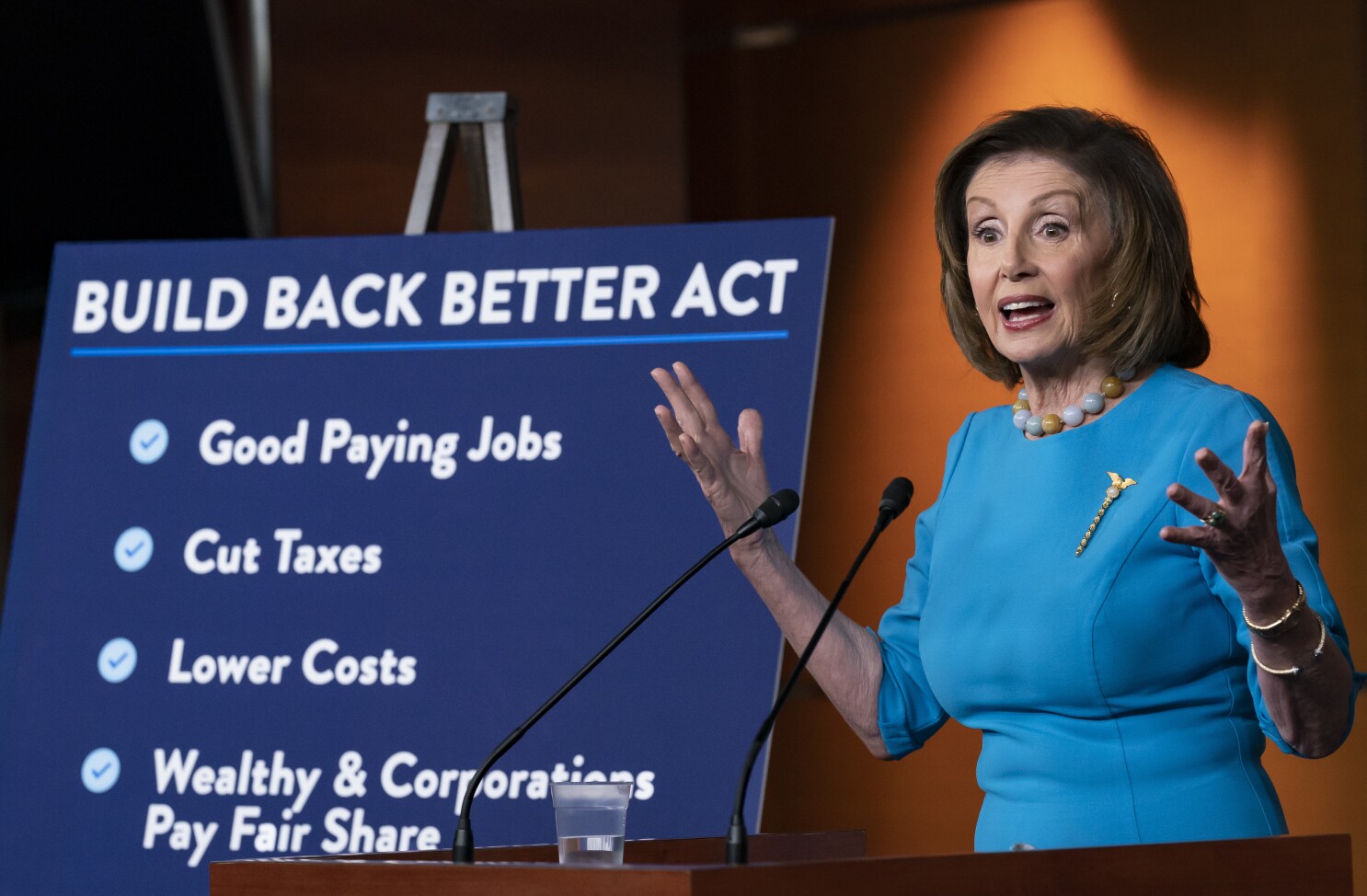

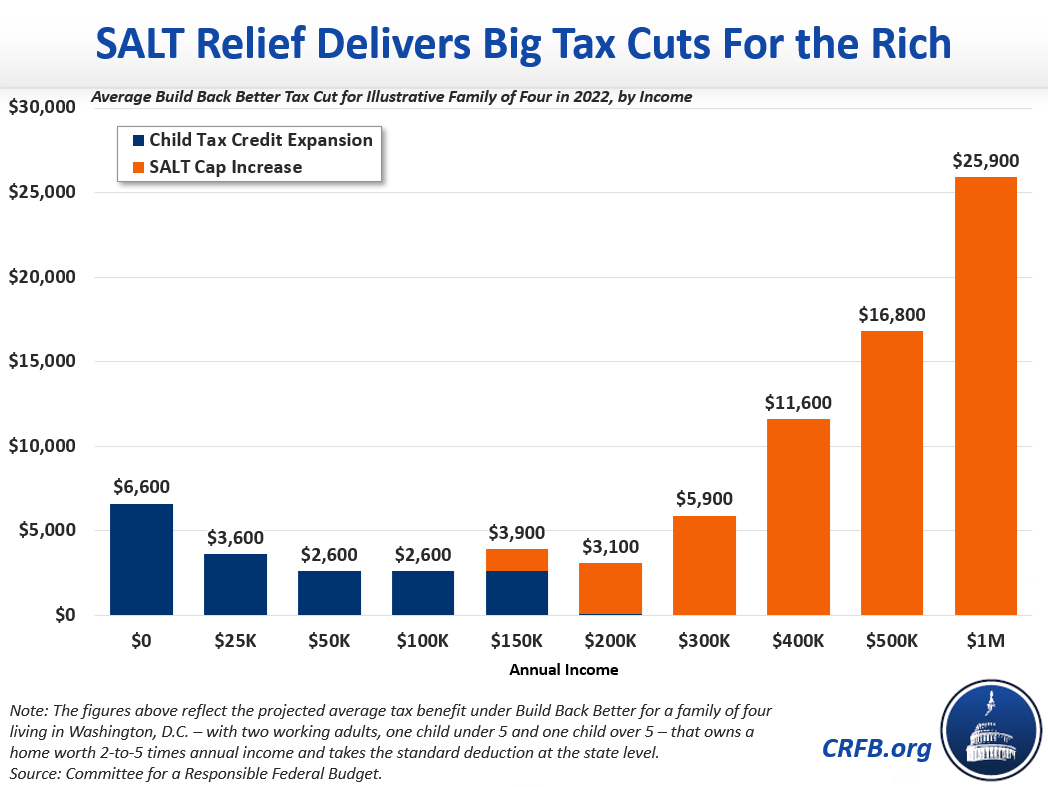

Amid the debate on Capitol Hill over the passing of President Bidens social spending agenda is the disagreement over raising the state and local tax SALT deduction for. Republicans are increasingly attacking Democrats for rolling back the 10000 cap on the state and local tax SALT deduction arguing it will largely benefit the rich.

Salt Break Would Erase Most Of House S Tax Hikes For Top 1 Bloomberg

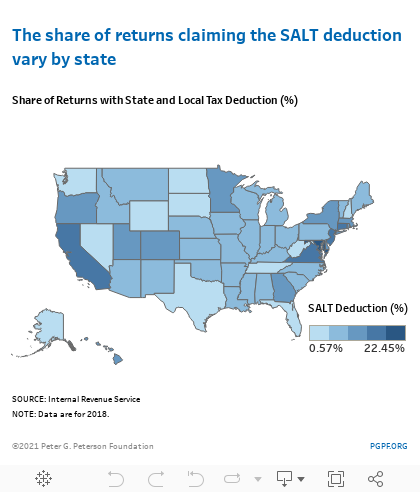

The SALT benefit was capped at 10000 in the 2017 Republican tax law and many Democrats come from areas where the average amount of tax paid far exceeds that limit.

. Taxpayers nearly 101 billion more this year with 335. Republicans established the 10000 cap on the SALT deduction in an effort to raise revenue to help offset the cost of tax cuts elsewhere in their 2017 law which reduced. The tricky politics of raising the SALT capor not Republicans created the 10000 cap on SALT deductions as a means to offset the cost of their other tax cuts in the 2017 Tax.

Taxpayers can deduct up to 10000 of. Enacted by the Tax. According to the Tax Policy Center 16 of tax filers with income between 20000 and 50000 claimed the SALT deduction in 2017 compared to 76 for tax filers with income.

The much-maligned top 1. This limit applies to single filers joint filers and heads of household. The value of the SALT deduction as a percentage of adjusted gross income AGI tends to increase with a taxpayers income.

She oversaw tax coverage for Bloomberg News. 1 day agoBy Brendan J. Erin Cleavenger The Dominion Post Morgantown WVa.

The state and local tax deduction cap commonly known as SALT was enacted as part of President Donald Trumps 2017 tax reforms. Both Gottheimer and Suozzi have been some of the most vocal advocates for SALT playing a pivotal role in getting the language to increase the cap from 10000 to. Dec 6 2021 748PM EST.

The SALT tax deduction is currently capped at 10000. The Washington-based Institute on Taxation and Economic Policy recently estimated the SALT cap will cost US. As Congress wrestles over changes to the 10000 cap on the federal deduction for state and local taxes known as SALT many business owners already qualify for a workaround.

52 rows As of 2019 the maximum SALT deduction is 10000. OReilly Ever since the federal Tax Cuts and Jobs Act of 2017 put a 10000 cap on the state and local tax deduction state lawmakers and individual taxpayers. December 12 2021 1230 PM 4 min read Dec.

Many New Jersey residents pay more than 10000 in property taxes. The deduction cap should be fully eliminated but Hill haggling may just raise it to a higher number say 15000 or 20000. We should be able to deduct our full.

Before the creation of a cap on this deduction 91 of the benefit. Since the SALT cap was put into place however. Talks were making progress on the.

The deal which was included in President Bidens sprawling Build Back Better plan late Thursday night would raise to 80000 the annual amount of state and local taxes that. Big Changes to the SALT Cap are Coming. The deduction has a cap of 5000 if your.

The latest SALT deduction bill introduced by Representatives Tom Malinowski of New Jersey and Katie Porter of California would remove the current 10000 cap entirely for. Your Family Can Live With a 30000 SALT Deduction Cap. A new bill sponsored by a pair of Democrats in the House of Representatives seeks to repeal the 10000 cap on state and local tax deductions.

12There has been a lot of discussion amongst government leaders about the cap on state and local. And while its presently due to sunset in 2025 Suozzi. Include a repeal of the federal cap on deductions for state.

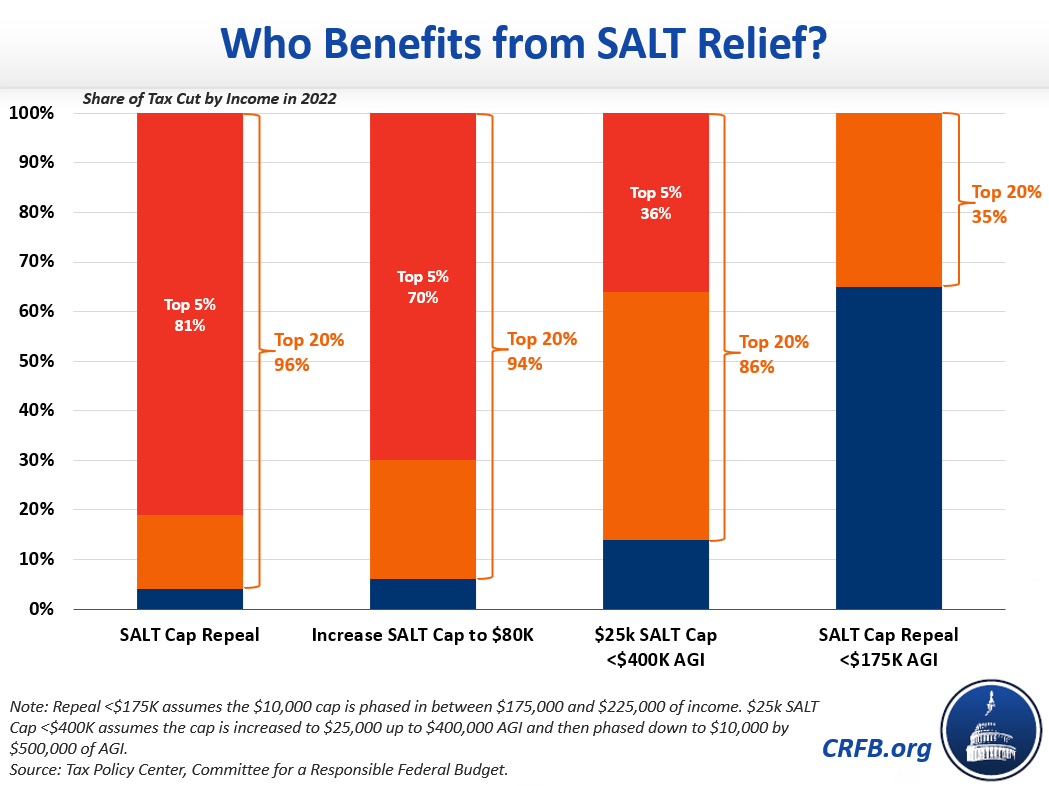

The left-leaning Brookings Institute found that the top 20 percent of earners would receive 96 percent of benefits of lifting the cap on SALT deductions. The SALT deduction applies to property sales or income taxes already paid to state and local governments. While the 10000 ceiling on the SALT deduction is set.

Repeal Trump S 1 7 Trillion Tax Cut Then Negotiate Salt Los Angeles Times

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

New Free Stock Photo Of Hand Pen Writing Tax Guide Inheritance Tax Tax Deductions

Salt Here S How Lawmakers Could Alter Key Contentious Tax Rule

U S Rep Brad Schneider Named To Ways Means Vows Salt Deduction Battle Deduction Battle Vows

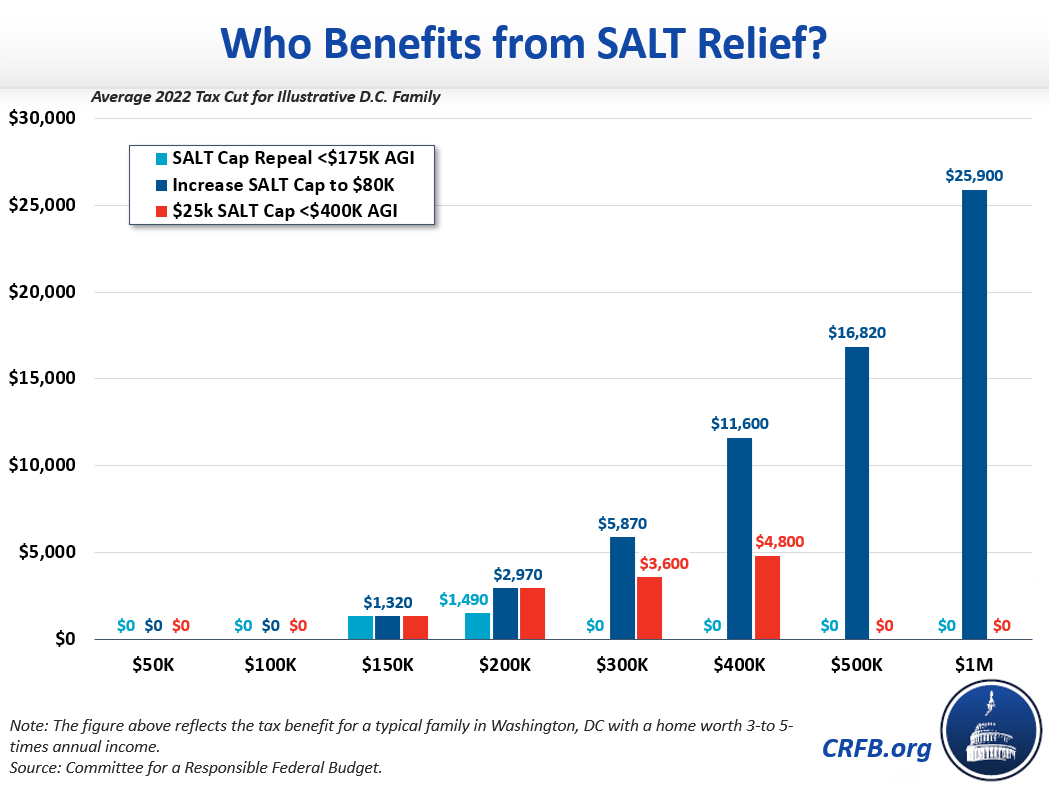

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

Most New York Times Matt Dorfman Design Illustration Illustration Design Newspaper Design Health Magazine Layout

Salt Deduction Biden S Spending Bill Why A Flat Tax Should Be Considered Steve Forbes Forbes Youtube

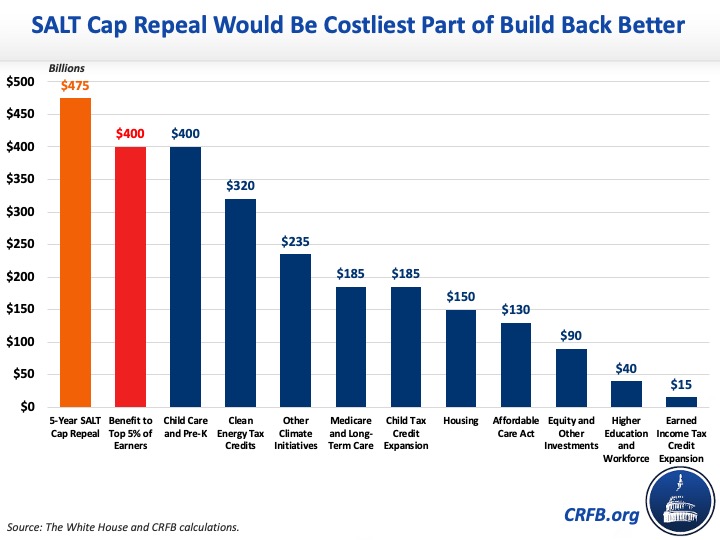

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

House Raises Salt Tax Deduction Cap From 10k To 80k In Build Back Better Senate Plans Changes So Millionaires Won T Get Tax Cut Yonkers Times

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

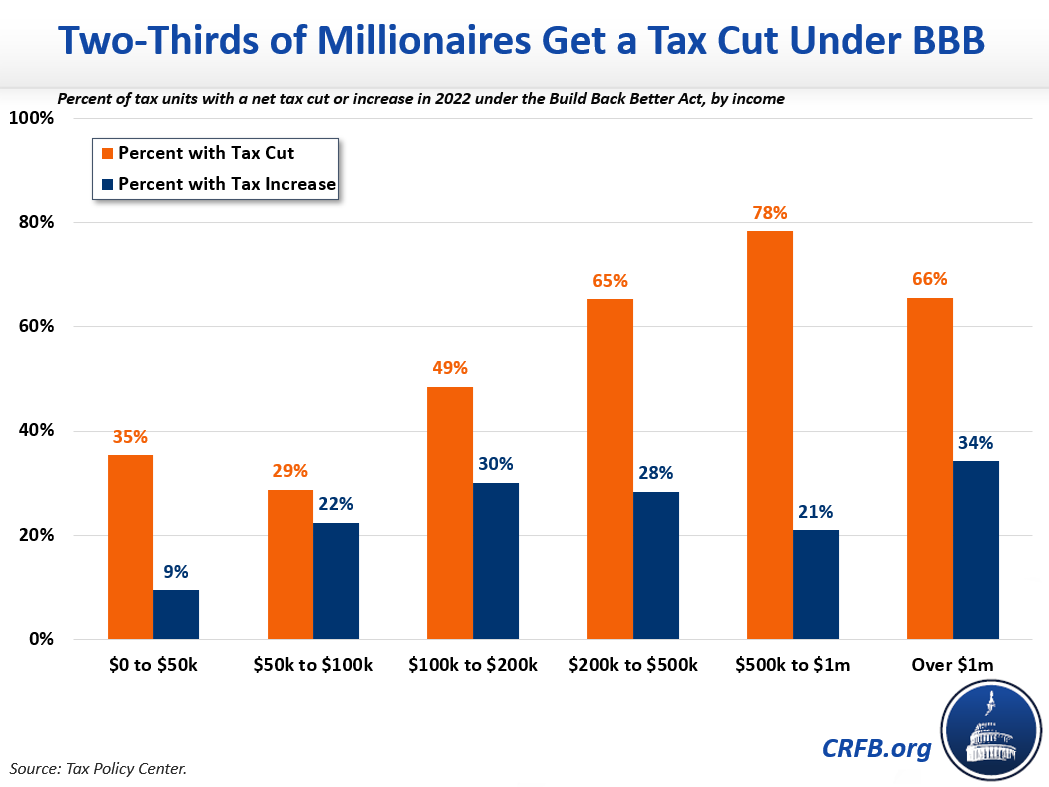

Two Thirds Of Millionaires Get A Tax Cut Under Build Back Better Due To Salt Relief Committee For A Responsible Federal Budget

Solar Reserve Diagram Solar Power Plant Solar Generator Solar Power

What Will You Do With Your Tax Refund How About A Mobile Makeover Phone Plans Cricket Wireless Best Cell Phone

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

We Re No 51 Utah Last Again For Per Student Spending Tuition Vocational School Bloomberg Business